Military service members and veterans have seen major changes to their pay and benefits over the past year. A new retirement benefit, revised rules for Tricare health insurance and changes to GI Bill rules can have a far-reaching impact on the lives and livelihoods of military families around the world.

For the most part, it’s good news. Basic pay is once again rising at the same rate as private-sector wages after several years of tight Pentagon budgets resulted in service members losing some ground compared to their civilian counterparts. The new retirement benefit, which includes cash contributions to a Thrift Savings Account, is a major boost for the vast majority of the force that serves for six or eight or ten years but never reaches the 20-year mark to become eligible for a lifelong pension.

Yet revisions to health care coverage and the GI bill education benefits are more complex, and may impact individual service members, veterans and their families in different ways.

Maximizing the options available to you is essential to making the most out of your military career. These are generous benefits. You’ve earned them. Getting smart about what has changed and what hasn’t is worth your time.

Basic pay is getting its biggest boost in a decade

A look at the basics that make up your basic pay … and what could be in store for your bank account come 2022:

What is basic pay?

Basic pay is determined by rank and length of service, with automatic raises when troops meet certain time and promotion markers. In addition, each year Congress determines how much of a pay raise all troops should get.

The figure is tied by law to the anticipated increase in private sector pay, but lawmakers in the past have approved bigger raises to help with recruitment and retention or smaller raises to save money for other military priorities.

Annual pay increases

The annual military pay increase takes effect in January of each year. The White House issues its target for the hike each August, either going along with the projected rise in private sector wages, known as the Employment Cost Index, or offering justification for proposing a different rate.

Congress has the final say, however. In the past, lawmakers have overridden attempts by the White House to submit lower pay raises in an effort to save money for other priorities. The raise is usually applied across the board, although lawmakers made an exception at the height of the wars in Iraq and Afghanistan to provide more money for some mid-career service members to help with retention.

The most junior enlisted service members make around $25,000 a year in basic pay (not including allowances, special pays and other benefits), while enlisted troops nearing retirement typically earn about $70,000 annually.

Officer pay is significantly higher: The most junior officers clear close to $40,000 a year while senior officers nearing 20 years of service can make in excess of $170,000. That means that even a small change in the anticipated pay raise calculations can make a big difference for military families.

For example, in recent years (but not for 2021) the Pentagon has backed plans for a pay raise 0.5 percent below the federal formula for the annual increases.

If that reduction were put in place for 2021, an E-4 with three years of service would see a difference of about $150 in take-home pay over the course of a year compared to the expected level of pay boost. For a senior enlisted or junior officer, the difference is closer to $300 over 12 months.

Outside advocates have said even though those gaps won’t cover a mortgage payment, they are the difference between being able to afford a monthly co-pay for prescriptions or having to go without. That makes even small increases or trims a major issue in the military community.

Since the start of the all-volunteer military force in 1973, Congress has authorized a pay raise of at least 1 percent for troops every year, even during budget cycles where other civilian wages held steady. For the last four years, those increases have matched the rate of expected growth in civilian wages.

This year’s pay raise

The 3.0 percent pay raise troops received in January 2021 was just slightly below the 3.1 percent raise they got in 2020. That increase matched the federal formula based on the annual Employment Cost Index calculation, and was the first time in a decade that troops saw back-to-back years of pay boosts of 3 percent or greater.

For junior enlisted troops, the raise means about $860 more in take-home pay this year. For senior enlisted and junior officers, it’s about $1,500 more. An O-4 with 12 years service would see more than $2,800 extra next year under the increase.

Discussions on the fiscal 2022 pay raise have not yet begun on Capitol Hill, because of delays related to the new administration taking over in January. The ECI formula calls for a 2.7 percent pay raise in 2022, slightly below this year’s raise.

Congress is expected to debate the pay raise level along with the rest of the defense budget over the next few months. Typically, the full budget plan is not approved until winter, even though the next fiscal year begins Oct. 1.

Current BAH rates aim to cover 95 percent of housing costs

This year, Basic Allowance for Housing increased 2.9 percent this year, up from 2020′s 2.8 percent increase, setting the tax-free benefit at a level intended to cover 95 percent of the anticipated housing costs for each assigned duty post in the U.S. Individual service members are now expected to pay the remaining 5 percent of housing costs with out-of-pocket cash.

What is BAH?

Basic Allowance for Housing provides service members not living on base or in government-provided housing a cash supplement to be able to rent housing at local market rates. The amount paid to a service member depends on rank, whether or not they have dependents, and where they are based.

Eligibility

Any active-duty service member stationed in the 50 U.S. states who is not provided with government housing is eligible. Those stationed in U.S. territories, possessions or overseas who are not provided government housing are eligible for an Overseas Housing Allowance, which is calculated under a separate formula.

Noteworthy

BAH is non-taxable, and unlike the Overseas Housing Allowance, if a service member can find housing below the BAH rate for their assigned location, they are able to pocket the difference, because what service members actually spend is not used to calculate BAH. (In Overseas Housing Allowance, however, it’s “use it or lose it.” Service members lose whatever portion of OHA they do not spend.)

How BAH is calculated

DoD calculates median rental costs for 300 military housing areas, including Alaska and Hawaii. The calculations are based on the rental costs for a 1 or 2 bedroom apartment, a 2 or 3 bedroom townhome, and a 3 or 4 bedroom single family home, and then set against specific enlisted and officer ranks for a service member with dependents and service members without dependents.

Rates very widely

Based on rank and the local real estate market, what you take home can be less than $1,000 or more than $3,000. For example, an E-1 at Fort Bragg, North Carolina without dependents would receive $954 according to the 2021 BAH Calculator. On the other hand, a colonel or Navy captain working in Washington, D.C. with dependents would receive $3,171, based on the 2020 rates.

Check your rates

For details of locations across the country, you can use the Defense Department’s official BAH calculator here.

What if BAH for my area is cut while I live there?

Service members are protected from falling rates under a rate protection policy that maintains their current rate for as long as they remain at their location, regardless of whether the official rates drop. However, they will receive the new, lower rate if they are demoted or if their dependency status changes, in which case they’d receive the current rate for their new status.

If rates rise in a location, all service members receive the higher rates regardless of when they arrived. Two rates are set for each location by a survey of rental costs: The with-dependents rate goes to personnel with at least one dependent, whether that be a spouse or a child, and does not increase for additional family members.

What if my spouse and I are both in the military?

If there are no children, both spouses get the without-dependents rate. If the couple has children, one spouse receives the with-dependent BAH rate, while the other gets the single-rate BAH.

You can find more information here.

Your new retirement benefits: The biggest change in decades

As of 2018, all service members entering the military are automatically enrolled in the new Blended Retirement System, or BRS. Only those with service prior to 2018 remain in the legacy, all-or-nothing 20-year pension plan.

BRS combines traditional monthly retirement checks of the legacy system with some new features that allow military members to take some government benefits with them even if they don’t serve up to the 20-year mark to qualify for a retirement pension.

Historically, only 19 percent of active-duty service members and 14 percent of National Guard and Reserve members serve long enough to get retirement benefits.

In 2018, more than 400,000 eligible service members opted in to the new BRS, out of the 1.6 million currently serving active-duty and reserve troops who were eligible to make a choice between the legacy system and the new system.

Whether you opted in or are part of the new crop of service members automatically enrolled in BRS, you need to pay attention to the key elements of the BRS, because it’s a critical part of your retirement planning and financial future:

Retirement pay

Those currently retired under the legacy system will see a 1.3-percent increase in monthly their monthly benefits in 2021, down from 2020′s 1.6-percent cost-of-living increase.

Under BRS, you’ll get the traditional monthly retirement pay for life if you serve for 20 years or more and earn a full retirement from the military. But it’s 20 percent less than what it is under the legacy system.

If you retire from active duty with 20 years of service under BRS, you’ll receive 40 percent of the average of your highest 36 months of active duty pay as your retirement pay, and that percentage increases by 2 percent for each additional year of service. The retirement pay has an annual cost of living adjustment. (The legacy benefit provided 50 percent of your highest 36 months of pay.)

Thrift Savings Plan

The Thrift Savings Plan, or TSP, is like a private-sector 401(k) retirement plan savings account. The TSP has been available to service members for years, but there was no government match until now. The money you contribute to your TSP is always yours. You own the DoD contributions after you serve at least two years.

Here’s how it works: After you have served for 60 days, a TSP account will be created, and automatic deductions of 3 percent of your basic pay start going to your TSP. (You can change that amount, but by law, you will automatically be reenrolled at 3 percent each year.) DoD kicks in 1 percent automatically, but will contribute up to an additional 4 percent of base pay to match your contributions.

So if you put in 5 percent of your base pay to your TSP, DoD also puts in 5 percent. Making your 5 percent contribution to your TSP is key to getting the maximum benefit out of BRS. BRS participants contributed more than $500 million to TSP accounts in 2018, and DoD added another $300 million in government automatic and matching contributions to those members’ TSP accounts.

While service members should contribute at least 5 percent of their basic pay to get the full DoD match — and not leave money on the table – everyone can contribute more, up to a limit of $19,500 in 2020. For those with civilian retirement accounts such as a 401(k) as well as a TSP, the contribution limits apply to the combined amounts.

Continuation pay

The services will make a one-time payout of continuation pay when the service member reaches 12 years of service. To receive that continuation pay, which is similar to a retention bonus, you must commit to serve an additional four years.

Active-duty members get 2.5 times their monthly basic pay as of the first day of their 12th year of service. Reserve and Guard members get 0.5 times their monthly pay – except for those in the Army Reserve and Guard, who get 4 times their monthly pay. It’s the prerogative of the services to adjust that multiplier to meet their needs, such as retention. Continuation pay is taxable, but you can also contribute all or part of it to your TSP. You can receive it in a lump sum or, to help reduce your taxes, you can opt to receive continuation pay in four equal installments over four years.

Lump sum retirement pay option

When you retire under BRS, you can request an up-front lump-sum payment of part of the retirement pay you’d receive before you reach full Social Security retirement age, which for most people is age 67. You can receive either 25 percent or 50 percent of its “discounted present value.” That means the amount is cut by a discount rate published yearly. For 2020, it’s a 6.75 percent reduction.

If you take the lump sum, the retirement checks are reduced by either 25 percent or 50 percent, depending on what percentage you received, until you reach age 67. At that point, your retirement check returns to its full amount. The lump sum is taxable; retirees can choose to receive the money in up to four installments over four years to reduce the tax burden.

TIP: To get the most out of your BRS benefit, make sure you’re contributing at least 5 percent to your Thrift Savings Plan account, to get the matching DoD contribution of up to 5 percent. Why turn down free money?

You can find more information about the Blended Retirement system here.

Help for military spouses and children

The year of the pandemic hit military families particularly hard, resulting in many spouses losing their jobs, shortages of child care, and many other issues. This exacerbated the challenges families face with frequent deployments and moving every two or three years, which already intensifies the needs of military families in many areas of their lives.

Bases worldwide offer families a wide variety of support services, from legal assistance and tax preparation, to child care, financial counseling, relocation assistance, education and employment assistance, youth programs, and deployment and mobilization support. The pandemic may have affected the availability of some services.

Central points of contact

Start with the family centers on military installations or MilitaryOneSource.mil, which offers access to additional assistance by phone or chat, 24 hours a day.

Most of the information on Military OneSource is available to the public, but some extra services are available for free to service members and their immediate family members, survivors of deceased service members, and certain others. Retiring or separating service members (and their immediate family members) can also access these services for one year after they leave the service.

Among those services are nonmedical counseling — available in person, by phone, secure chat or secure video session — as well as financial counseling, including tax preparation and tax filing help. Spouse employment and education services; language translation services for documents, health and wellness coaching, child/youth behavioral counseling, and family life counseling are also available.

For decades, two of the biggest issues for military spouses have been finding employment and finding good quality, affordable child care. Here are some of the programs that address those needs:

Spouse employment and education

Spouses can visit their installation’s family center for employment and education assistance. They can also visit the Spouse Education and Career Opportunities, or SECO, section at MilitaryOneSource.mil for information on scholarships and other education and employment needs. SECO offers a free, personalized benefit through certified career counselors to help spouses investigate career options, education options or entrepreneurial projects.

Through DoD’s My Career Advancement Account program, or MyCAA, spouses of certain junior service members can receive tuition assistance of up to $4,000, with an annual cap of $2,000, to pursue licenses, certifications or associate degrees needed for employment in any career field or occupation. This benefit is available to spouses of active duty members in paygrades E-1 to E-5, W-1 and W-2, and O-1 and O-2. Under a recent provision in law, military spouses remain eligible for this financial assistance if their military sponsor is promoted beyond the eligible ranks, as long as they have an approved education and training plan in place through the program.

Spouses can also search job opportunities on the Military Spouse Employment Partnership site, where hundreds of businesses that have been vetted by the Defense Department are seeking to hire military spouses.

What’s new

With the addition of 86 more companies and organizations, the number of employers committed to hiring military spouses recently hit 500, under the Military Spouse Employment Partnership.

And in a step toward easing the burden on military spouses who transfer their professional licenses after a PCS move, defense officials have approved grants to help develop license portability in five occupations: teaching, social work, cosmetology, massage therapy, and dentistry/dental hygiene. Others will follow.

Many military spouses spend time and money getting new professional licenses when they move to a new state. It costs money for exams and other fees, as well as lost pay potential as they go through the process. To help with these costs, the law allows spouses to apply to their service branch for reimbursement up to $1,000, for relicensing and recertification costs each time they relocate with their service member.

The Department of Labor has set up a website, based on DoD’s data about licensing, to help military spouses understand the laws of each state, and to find information about the appropriate licensing board in the states for each occupation.

Child care

The Defense Department child care systems include more than 600 child development centers, school-age care facilities and about 1,100 family child care homes at more than 230 locations worldwide. All are required to adhere to DoD regulations. These programs are nationally recognized for their quality, and programs meet strict standards for curriculum, safety and health. Fees are on a sliding scale based on total family income.

Any family child care provider on an installation who offers child care for other families’ children for 10 or more hours per week must be certified through installation officials. Families can get lists of certified family child care homes at their installation’s child development program office. They can also find certified family day care homes through the this official DoD website. That DoD site gives parents more visibility over what child care slots are available at multiple installations in a given area, and allows them to register and apply for child care in advance.

Military families can also find high-quality, subsidized child care in their local civilian community if care is not available on base. Families must register at the same DoD site for fee assistance through this program, operated through the nonprofit Child Care Aware of America. For more information, visit this site.

What’s new

DoD and the services are looking at new ways to ease the child care shortage, such as streamlining the hiring process for child care workers. As of September, 2020, working military families get higher priority in child care programs under a new policy. The policy also allows officials to displace children who are already in a child development program, whose parents are in a lower priority category, if the military family is expected to be on a wait list for more than 45 days after the time they need care.

Military families also have another option to help them find hourly and on-demand child care. Through MilitaryOneSource, families will get a paid subscription to a service that lets them search for child care providers in the nationally recognized Sittercity.com. DoD doesn’t pay for the child care, but pays for the subscription to the service that provides connections to available child care providers.

Ready to make the leap into home ownership?

The Department of Veterans Affairs home loan program took shape near the end of World War II and has been used by millions of service members and veterans since then: Nearly 3 million have VA-backed loans at present, and more than more than 700,000 loans are issued on a typical year.

What it is

The VA guarantees a percentage of an eligible beneficiaries’ home-purchase or home-refinance loan, allowing the lender to provide better, more affordable terms and often letting the borrower seal the deal without a big cash down payment.

What it does

Eligible service members and veterans can apply, via private-sector lenders, for home-purchase loans. As of 2020, there are no VA loan limits for veterans who have the full VA loan entitlement. For a VA-backed home loan, you’ll still need to meet your lender’s credit and income loan requirements in order to receive financing. These VA home purchase loans can be used to buy manufactured homes or homes under construction, in some cases, but not mobile homes.

The VA loan program also offers cashout refinance loans.

An Interest Rate Reduction Refinance Loan can reduce the rate on an existing VA-backed loans. These loans come with funding fees that vary by loan type and veteran status. Veterans using the benefit for the first time on a no-down-payment purchase loan pay a 2.3 percent fee, for example, while a veteran making a second cash-out refinance loan would pay 3.6 percent. A full fee table is available at https://www.benefits.va.gov by typing “loan fee” into the search window.

Veterans receiving VA disability compensation are exempt from fees. Other loans, including joint loans, construction loans and loans to cover costs of energy-efficient repairs, also can be backed by VA. Consult your lender for information.

Action items

The key step for service members and veterans is to obtain a Certificate of Eligibility, either through the eBenefits site or via their lender, to be eligible for a VA-backed loan.

Those seeking to refinance existing loans should read lenders’ advertising material carefully: VA and the Consumer Financial Protection Bureau issued a “warning order” against deceptive lending practices.

Among the red flags: Aggressive sales tactics, low interest rates with unspecified terms and promises that borrowers can skip a mortgage payment as part of the new loan — a practice prohibited by VA.

Deadline

VA loan eligibility does not expire, though the entitlement can only be used for the borrower’s place of residence (not a rental property). It can be reinstated after the loan is paid off or under other circumstances — another veteran can assume the loan, for instance. Learn more

Learn more from the VA here.

Eligibility

Service members whose time in uniform falls within these date ranges must have 90 days of active-duty service to qualify:

• Sept. 16, 1940-July 25, 1947

• June 27, 1950-Jan. 31, 1955

• Aug. 5, 1964-May 7, 1975 (Note: For those who served in the Republic of Vietnam, this era begins Feb. 28, 1961).

• For loan purposes, VA considers “Gulf War” service beginning Aug. 2, 1990, and continuing through the present day. Service members from that time period must have completed 24 months of continuous active-duty service to be eligible, or at least 90 days if they have the right discharge status.

• If your time in uniform doesn’t apply to the date ranges above and you were enlisted and separated on or before Sept. 7, 1980, or if you were an officer and separated on or before Oct. 16, 1981, you need 181 continuous active-duty days to qualify. If your service came after the above date ranges, you need 24 months of time in or less if you have certain discharges.

• Troops now on active duty become eligible after 90 days of service for as long as they remain on active duty. Reserve and National Guard members become eligible after six creditable years in service. Troops discharged for a service-connected disability are eligible regardless of service length.

What’s new

There are a number of protections on VA-guaranteed loans for those who are experiencing financial hardship due to the COVID-19 pandemic. For example, VA has extended its moratorium on foreclosures and evictions, through June 30, 2021. A mortgage company should not attempt to being a foreclosure during the moratorium. The federal law for VA home loans changed in 2020 to make it easier for veterans to buy homes in areas with high real estate values.

The new law took away the loan limit maximums previously required in certain areas of the country.

VA officials are monitoring another change in law which took effect in 2020 — the increase in the VA funding fee due at closing. For active duty members and veterans who are first time buyers, it increases by 0.15 percent, now at 2.3 percent of the loan.

Additional details of the home loan process are available here.

For more eligibility details, visit VA’s eBenefits site or call 877-827-3702.

Tricare changes: What you need to know

As the pandemic bore down on the country, the military’s Tricare health program made changes to make it easier for military beneficiaries to get care, by covering telehealth visits by telephone, and eliminating patient co-pays and cost shares for telehealth options during the pandemic.

For several years, Tricare has covered the use of secure video conferencing to provide medically necessary services, allowing patients to connect with a provider using a computer or smartphone. Tricare has also expanded the medical services eligible for telehealth. But until the pandemic, Tricare didn’t cover the telephone-based telehealth services.

Tricare officials have reported a spike in patients’ use of telehealth during the pandemic.

Officials also temporarily relaxed licensure requirements across state lines for health care providers to give military families access to more providers.

And starting in 2021, more than 800,000 military retirees and their beneficiaries must pay new enrollment fees for Tricare Select.

That requirement is part of a 2017 law that overhauled the military’s Tricare health program.

What it is

Tricare is a health care program for almost 9.4 million beneficiaries that offers 11 different options, with choices depending on the status of the sponsor and the geographic location: Active-duty members; military retirees; National Guard and Reserve members; family members (spouses and children registered in the Defense Enrollment Eligibility Reporting System) and certain others, including some former military spouses and survivors, as well as Medal of Honor recipients and their immediate families.

Those entering the military on or after Jan. 1, or changing status (i.e., from active duty to retired) should make sure they and their eligible family members are enrolled in the Tricare program of their choice. Those who don’t enroll may only receive care at a military clinic or hospital on a space-available basis, and medical care by civilian providers wouldn’t be covered. The one-month open season begins on the Monday of the second full week in November and goes through the Monday of the second full week in December. During that time, you can enroll in a new Tricare Prime or Tricare Select plan; or change your enrollment. If you’re satisfied with your current Tricare health plan you don’t have to take action to stay enrolled.

The law overhauling Tricare included the strict limitation on switching between Tricare plans. As of 2019, beneficiaries can’t switch between Tricare Prime and Tricare Select until the yearly open season starting each November, unless there’s some sort of qualifying life event, such as the birth of a baby, a move to a new duty station, marriage or retirement.

And for retirees, a new dental program, the Federal Employees Dental and Vision Insurance Program, or FEDVIP, has replaced the now-defunct Tricare Retiree Dental Program.

The details

Tricare offers two core options: Tricare Prime and Tricare Select. Select replaced Tricare Standard and Tricare Extra in 2018. All active-duty members are required to enroll in Tricare Prime; they pay nothing out of pocket. Active-duty families can enroll in Tricare Prime without an enrollment fee. Prime beneficiaries are assigned a primary care manager, or PCM, at their local military treatment facility or, if one is not available, they can select a PCM within the Tricare Prime network. Specialty care is provided on referral by the PCM, either to specialists at a military facility or a civilian provider.

Tricare Select is similar to a traditional fee-for-service health plan. Patients can see any authorized provider they choose, but must pay a deductible and co-pays for visits. Patients pay lower out-of-pocket costs when they receive care from a provider within the Tricare network.

All Tricare programs have a cap on how much a family pays out of pocket each fiscal year, depending on the sponsor’s status and the type of Tricare program used.

The plans

• Tricare Prime: Prime is similar to a health maintenance organization, which has lower out-of-pocket costs but requires enrollees to use network providers and coordinate care through a primary care manager — a doctor, nurse practitioner or medical team. It’s free to active-duty members and families; retirees must pay an annual enrollment fee ($303 for an individual, $606 for a family in 2021). Those whose initial period of service began before Jan. 1, 2018 are grandfathered in to these rates. Co-payments for medical visits are lower than other programs, and there are no deductibles unless patients get care outside the network.

• Tricare Prime Remote: Service members who live and work more than 50 miles or an hour’s drive from the nearest military treatment facility must enroll in Tricare Prime Remote. Family members are eligible if they live with an enrolled service member in a qualifying location, or they may use Tricare Select.

• Tricare Prime Overseas/Prime Remote Overseas: Tricare Prime Overseas is a managed-care option for active-duty members and their command-sponsored family members living in nonremote locations. They have assigned primary care managers at a military treatment facility who provide most care and referrals for and coordination of specialty care. Tricare Prime Remote Overseas is a managed care option in designated remote overseas locations, with most care from an assigned primary care manager in the local provider network, who provides referrals for specialty care. Activated National Guard and Reserve members and their families also may enroll in these options while the sponsor is on active duty; retirees and their families aren’t eligible.

• Tricare Select: This is a preferred provider plan — authorized doctors, hospitals and other providers are paid a Tricare-allowable charge for each service performed. Costs are higher for out-of-network providers, and certain procedures require pre-authorization. There is no enrollment fee for active-duty families. Starting in 2021, retirees who entered the network before Jan. 1, 2018 are now paying monthly enrollment fees -- $12.50 per month for individuals or $25 a month for families. Copays vary by status and type of care: An in-network primary care outpatient visit costs retirees and their families $30, for example, while some active-duty family members pay $22 and others — those whose sponsor entered the network on or after Jan. 1, 2018, pay $15.

• Tricare Reserve Select: Qualified Selected Reserve members can buy Tricare coverage when they are in drilling status – not mobilized. The program offers coverage similar to Tricare Select.

• Tricare Retired Reserve: “Gray area” National Guard and Reserve retirees who have accumulated enough service to qualify for military retirement benefits but have not reached the age at which they can begin drawing those benefits (usually age 60) can purchase this insurance, which offers coverage similar to Tricare Select.

• Tricare for Life: This wraparound program is for retirees and family members who are eligible for Tricare and Medicare. The provider files the claims with Medicare; Medicare pays its portion and then sends the claim to the Tricare for Life claims processor. Enrollees must enroll in Medicare Part A (free for those who paid Medicare taxes while working) and Part B (monthly premium required) to receive Tricare for Life.

• Tricare Young Adult: Unmarried dependent children who do not have private health insurance through an employer may remain in Tricare until age 26 under a parent’s coverage via TYA Select or TYA Prime. Premiums are required for both.

• US Family Health Plan: Beneficiaries who live in one of six designated areas, can enroll in this as a Prime option. Those enrolled get all their care, including prescription drugs, from a primary care provider the beneficiary selects, from a network of private doctors affiliated with one of the not-for-profit health care systems in the plan. Beneficiaries don’t get care at military hospitals or clinics, or from Tricare network providers when enrolled in the US Family Health Plan.

ACTION ITEMS

Beneficiaries must take action to enroll in a Tricare plan in order to be covered for civilian health care. Those who don’t enroll will only be able to get health care at a military clinic or hospital on a space available basis.

Retirees have until the end of June to reinstate coverage if they were dropped from Tricare Select coverage in 2021 because they didn’t set up a process for paying the new enrollment fees that went into effect Jan. 1. By law, these retirees in the so-called “Group A” – working age retirees under age 65 who entered the military before Jan. 1, 2018 -- were required to start paying enrollment fees in 2021, which are $12.50 per month for individuals or $25 per month for families. These working age retirees should contact their Tricare contractor to set up the payments.

To be eligible for any of the Tricare plans, beneficiaries must first be enrolled in the Defense Enrollment Eligibility Reporting System. Active-duty members are automatically registered in DEERS when they join the military, but they must register eligible dependent family members. Service members should make sure the information is correct for their family members. Only military members can add or remove family members; this is done through the local ID card office.

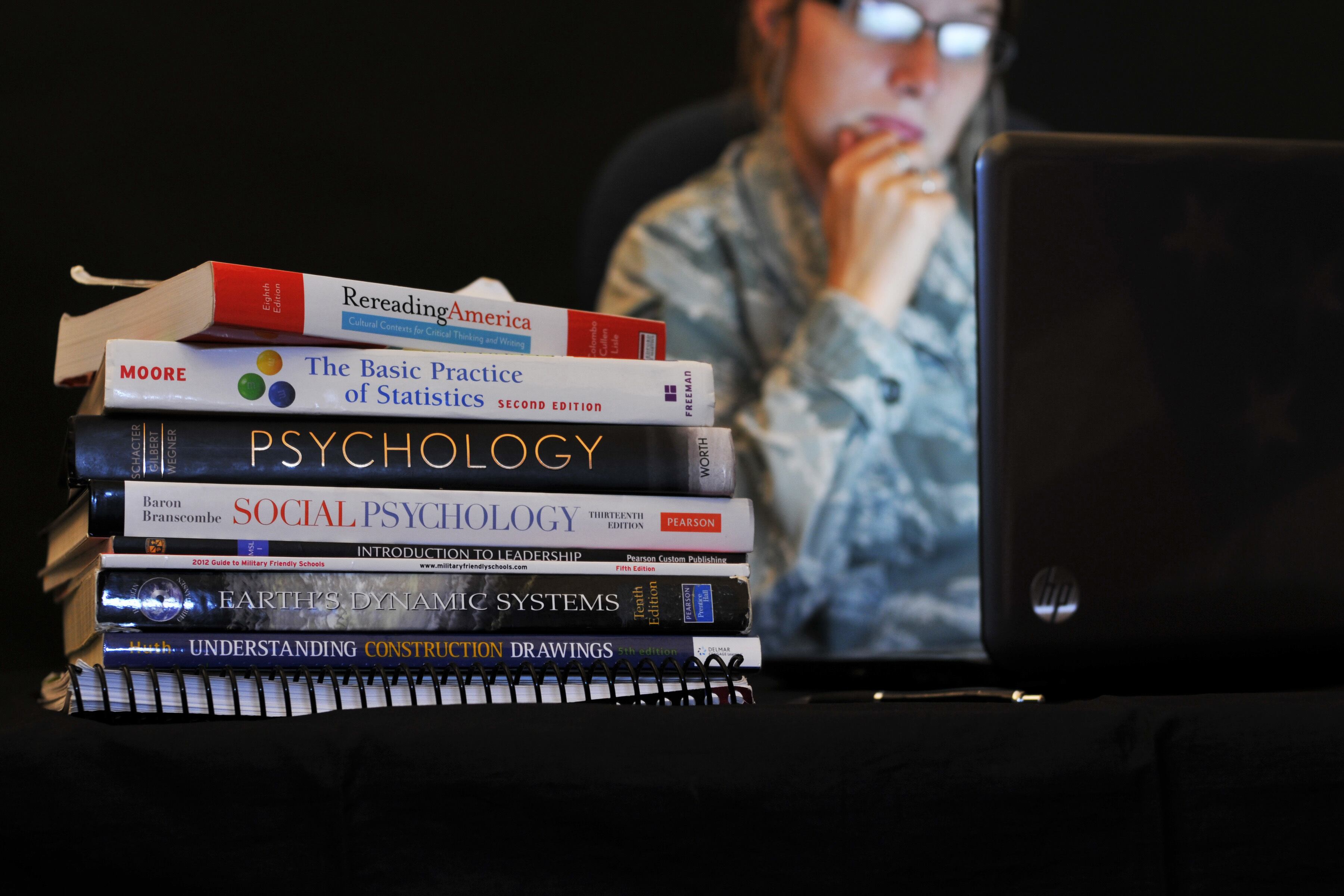

GI Bill and tuition assistance: Know your education benefits

The Post-9/11 GI Bill is a benefit for the latest generation of service members and veterans, as well as their eligible dependents. It includes payment of tuition and fees, a monthly housing allowance, and a stipend for textbooks and supplies.

GI Bill eligibility

The amount of time you spent on active duty determines your benefit level. In general, the higher your benefit level, the less you have to pay out of pocket for school, maxing out at the 100% benefit level, which covers full in-state tuition at public universities.

Here’s what veterans who received an honorable discharge after Sept. 10, 2011, are eligible for based on the amount of time they’ve served:

• 100%: 36 months or more of active duty service, or at least 30 continuous days and discharged due to service-connected disability

• 90%: At least 30 months, less than 36 months.

• 80%: At least 24 months, less than 30 months.

• 70%: At least 18 months, less than 24 months.

• 60%: At least 6 months, less than 18 months.

• 50%: At least 90 days, less than 6 months.

• No benefit: Less than 90 days.

What it covers

You can use your benefits toward an education at a college, university, trade school, flight school or apprenticeship program.

While the benefit covers all in-state tuition and fees at public institutions, it may not have the same reach at a private or foreign school. The maximum tuition coverage for private nonprofit, private for-profit and foreign schools for the 2020-21 school year was $25,162.14. That figure is expected to increase again in August.

Housing stipend

The housing stipends GI Bill users receive depend on the level of benefits they’re eligible for, how many courses they take and where they go to class.

The rate is determined by DoD’s Basic Allowance for Housing scale and is paid at the same rate an active-duty E-5 with dependents would receive in a particular area. If you are pursuing a degree entirely online, you get half of the national BAH average.

However, Congress passed changes to the program at the start of the coronavirus pandemic to allow students forced online by campus closures and virus mitigation efforts to receive full housing benefits. Those protections are set to last through 2021.

The VA had historically based the housing allowance on the location of the main campus of a school, even if the student in question is taking classes at a different branch campus that could be many miles away. However, in 2019, the Forever GI Bill directed VA to instead base the housing allowance on the location where a student takes most of his or her classes.

Transfer rules

Service members may transfer their benefits to a dependent, provided they have already served in the military for at least six years and agree to serve four more after the transfer is approved by the DoD.

The transfer must happen while you are still in uniform. Veterans who have already separated from the military are not eligible to transfer their benefits. Children are only eligible to start using the transferred benefits after the service member doing the transfer has completed at least 10 years of service. Spouses can use the transferred benefits right away.

What’s new

• In 2019, Congress eliminated rules mandating that some benefits be used within 15 years of the servicemember’s separation from the military.

• A pending court case could allow veterans who are eligible for both the Post-9/11 GI Bill and the Montgomery GI Bill to use both benefits consecutively, essentially giving some veterans another 12 months of education benefits. The issue is under appeal, and may not be settled in time for the start of the 2021-2022 academic year.

• Active-duty troops who received a Purple Heart for combat injuries are now allowed to transfer their benefits to dependents regardless of how long they served or their ability to commit to more service.

• Starting in August 2022, active-duty servicemembers will also be eligible for the VA Yellow Ribbon program, which allows private schools to match VA benefits with their own tuition assistance.

• In 2019, Defense Department officials announced plans to make deployments to the U.S. southern border for guardsmen and reservists to count towards the 90-day requirement for GI Bill eligibility. Earlier this year, they did the same for Guardsmen deployed to Capitol Hill for security missions there. The move is expected to give partial benefits to thousands of previously ineligible individuals, and lawmakers have pushed in recent years to extend that eligibility even further.

More online

You can find more detailed info about the GI Bill here.

You can find a GI Bill Comparison Tool here.

You can apply for the Post-9/11 GI Bill online or by visiting a local VA regional office. If you’ve already chosen a school or program, arrange a meeting with the institution’s VA certifying official, who can help you get started.

Tuition Assistance

Service members have more education benefits available to them than just the GI Bill.

While service members can begin to use their GI Bill benefits on active duty, they can often get help paying for college from their service branches – and save the GI Bill for later – by using tuition assistance.

Here’s how TA works, and what you’ll need to know to make the most of it:

What it is

TA is a federal benefit that covers the cost of tuition, up to particular limits, for active-duty service members, as well as some members of the National Guard and reserves. The funds are paid directly to schools by the service branches.

Eligibility

Each service has its own requirements.

• Air Force: All Air Force officers incur a service requirement if they use TA, but there is no service-length requirement to begin using the benefit.

• Navy: Enlisted sailors and officers, including Naval Reservists, must have a minimum of two years of military service before becoming eligible to use TA.

• Army: As of Aug. 5, 2018, there is no longer a one-year waiting period after completion of Advanced Individual Training, Basic Officer Leader Course or Warrant Officer Basic Course to receive TA. Active-duty officers incur a two-year service obligation.

• Marine Corps: After previously having to wait 18 to 24 months to use TA, Marines now have no minimum service-length requirements for the benefit. However, they must agree to at least two more years of active duty service to use the benefit.

• Coast Guard: Active-duty Coast Guard members must have been on long-term active-duty orders for more than 180 days to access TA. The Coast Guard also has unit-specific requirements and requires commanding officer approval.

• Guard/Reserve: Soldiers who are activated or on drill status are eligible under the same conditions as active-duty Army personnel. Air National Guardsmen and reservists of other branches are eligible for TA if they are activated, and the use of TA often comes with a service obligation for a certain amount of time once the last course is completed.

Limits

The Defense Department caps tuition assistance at $250 per semester hour and $4,500 per fiscal year. The Coast Guard recently decreased its annual cap to $2,250 per year, down from $4,000. The Navy and Army set limits at 16 semester hours per year.

Generally, TA funds can be used to pursue a higher degree than what you have already earned, up to the master’s degree level. If you have a bachelor’s degree, you can use it to pursue a graduate degree — not an associate or second bachelor’s, though there are some exceptions. Some branches require you to create a degree plan or take a branch-specific course before your TA benefits are approved.